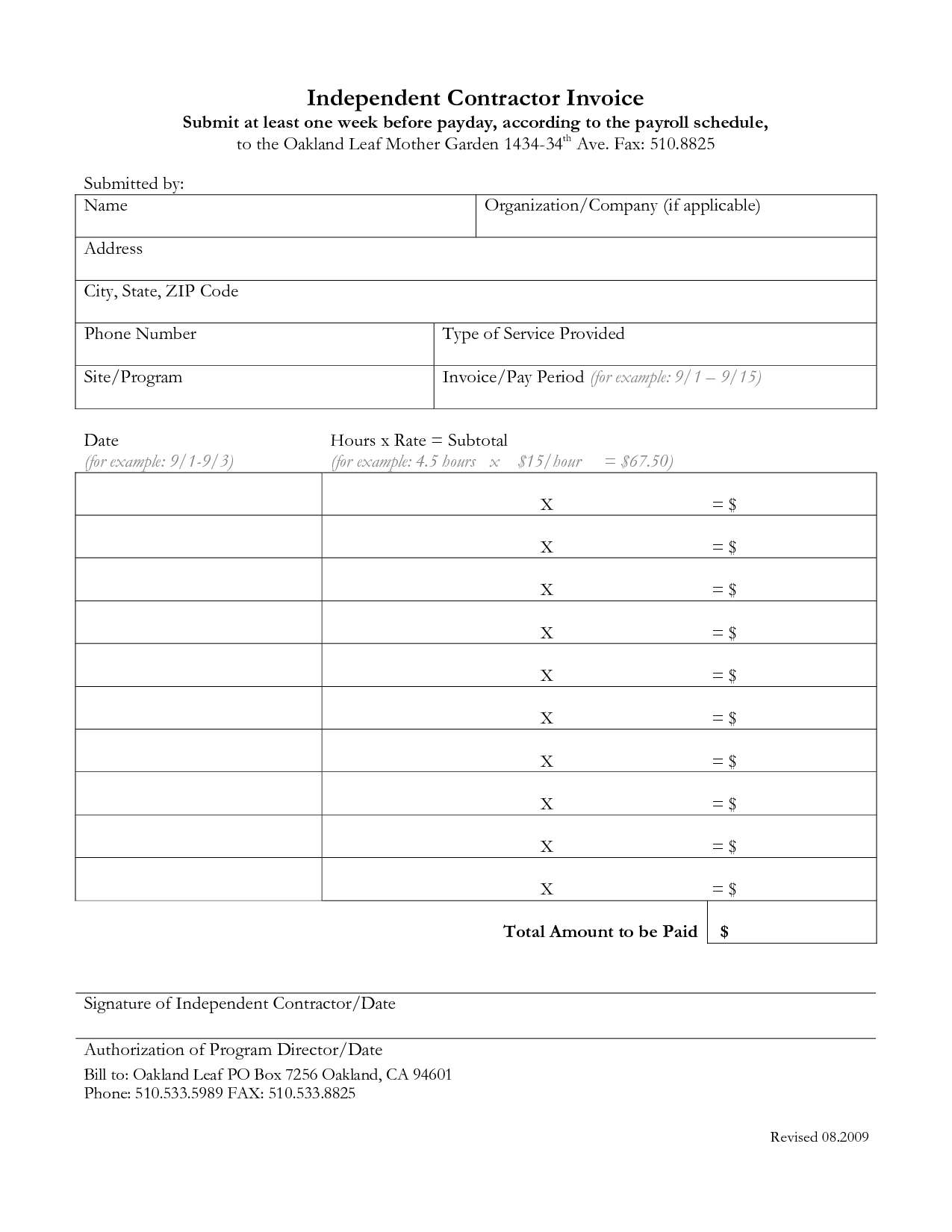

1099 Form Independent Contractor Pdf : Independent Contractor Invoice Template Excel | invoice - Should you expect a 1099 this year?

An official website of the united states government although these forms are called information returns, they serve different functions. If you received income outside of traditional employment wages, you report income received from a 1099 form. An official website of the united states government you may need to make quarterly estimated tax payments. How do i report this income? Working as an independent contractor gives you access to plenty of deductions that can help reduce your tax liability.

Should you expect a 1099 this year?

For millions of americans, filing taxes for 2020 has the potential to be the most complicated year of tax returns in decades. For information on estimated tax payments, refer to form 1. An official website of the united states government you may need to make quarterly estimated tax payments. Unfortunately this year, there are some new tax for. Working as an independent contractor gives you access to plenty of deductions that can help reduce your tax liability. However, the irs provides around 17 different 1099 forms, so things can get confusing. How do you determine if a worker is an employee or an independent contractor? An official website of the united states government although these forms are called information returns, they serve different functions. Must i file quarterly forms to report income as an independent contractor? Although a 1099 helps with filing, it isn't necessary to have one in order to file your taxes. These can include deducting costs for your home office, vehicle expenses, advertising, continuing education, insurance pr. If you received income outside of traditional employment wages, you report income received from a 1099 form. A record number of americans — apri.

How do i report this income? If you are an independent contractor for a business, you may wonder what the 1099 rules are for employers where contractors are concerned. Working as an independent contractor gives you access to plenty of deductions that can help reduce your tax liability. Although a 1099 helps with filing, it isn't necessary to have one in order to file your taxes. Must i file quarterly forms to report income as an independent contractor?

Unfortunately this year, there are some new tax for.

How do i report this income? If you are an independent contractor for a business, you may wonder what the 1099 rules are for employers where contractors are concerned. Although a 1099 helps with filing, it isn't necessary to have one in order to file your taxes. These can include deducting costs for your home office, vehicle expenses, advertising, continuing education, insurance pr. How do you determine if a worker is an employee or an independent contractor? Working as an independent contractor gives you access to plenty of deductions that can help reduce your tax liability. Unfortunately this year, there are some new tax for. For millions of americans, filing taxes for 2020 has the potential to be the most complicated year of tax returns in decades. If you received income outside of traditional employment wages, you report income received from a 1099 form. Most people make their living collecting a paycheck. An official website of the united states government although these forms are called information returns, they serve different functions. An official website of the united states government you may need to make quarterly estimated tax payments. However, the irs provides around 17 different 1099 forms, so things can get confusing.

However, the irs provides around 17 different 1099 forms, so things can get confusing. How do i report this income? For millions of americans, filing taxes for 2020 has the potential to be the most complicated year of tax returns in decades. A record number of americans — apri. Although a 1099 helps with filing, it isn't necessary to have one in order to file your taxes.

Although a 1099 helps with filing, it isn't necessary to have one in order to file your taxes.

Unfortunately this year, there are some new tax for. An official website of the united states government although these forms are called information returns, they serve different functions. How do you determine if a worker is an employee or an independent contractor? If you are an independent contractor for a business, you may wonder what the 1099 rules are for employers where contractors are concerned. How do i report this income? Must i file quarterly forms to report income as an independent contractor? However, the irs provides around 17 different 1099 forms, so things can get confusing. An official website of the united states government you may need to make quarterly estimated tax payments. For millions of americans, filing taxes for 2020 has the potential to be the most complicated year of tax returns in decades. An official website of the united states government the determination can be complex and depends on the facts and circumstances of each case. If you received income outside of traditional employment wages, you report income received from a 1099 form. Most people make their living collecting a paycheck. For information on estimated tax payments, refer to form 1.

1099 Form Independent Contractor Pdf : Independent Contractor Invoice Template Excel | invoice - Should you expect a 1099 this year?. How do i report this income? For information on estimated tax payments, refer to form 1. Must i file quarterly forms to report income as an independent contractor? Should you expect a 1099 this year? Most people make their living collecting a paycheck.

Posting Komentar untuk "1099 Form Independent Contractor Pdf : Independent Contractor Invoice Template Excel | invoice - Should you expect a 1099 this year?"